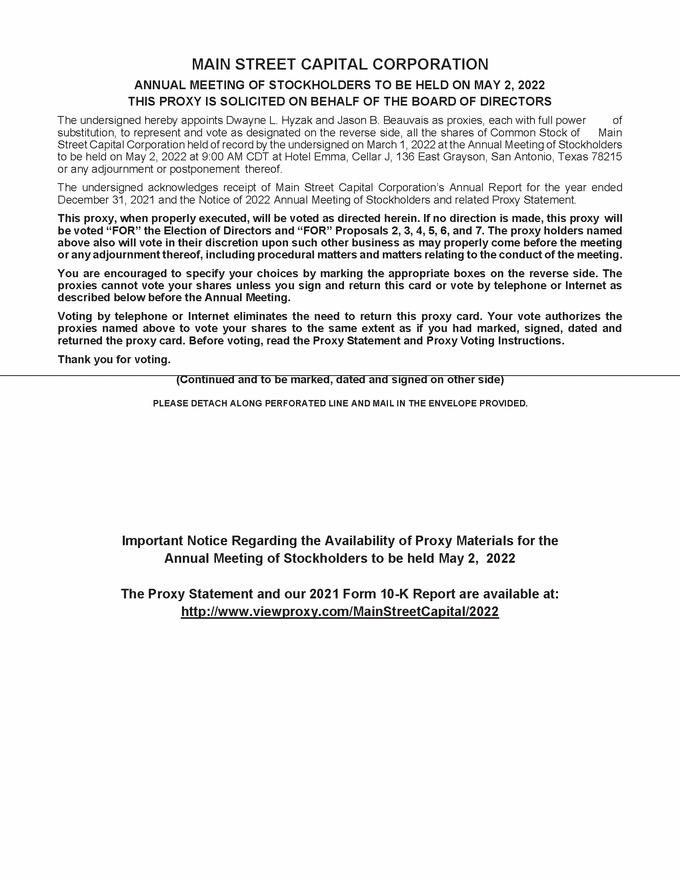

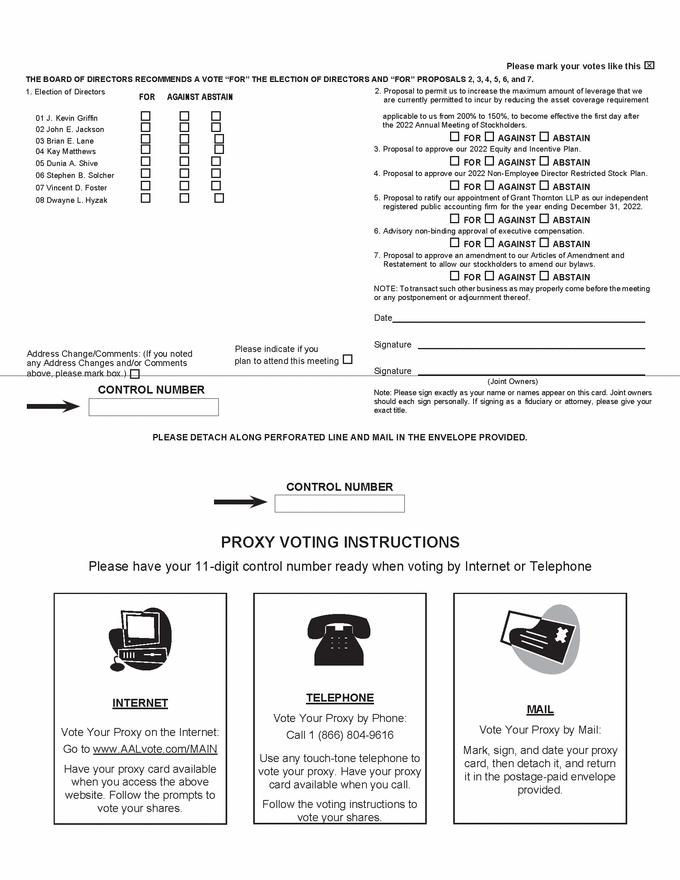

| MAIN STREET CAPITAL CORPORATION ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 2, 2022 THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS The undersigned hereby appoints Dwayne L. Hyzak and Jason B. Beauvais as proxies, each with full powerof substitution, to represent and vote as designated on the reverse side, all the shares of Common Stock of Main Street Capital Corporation held of record by the undersigned on March 1, 2022 at the Annual Meeting of Stockholders to be held on May 2, 2022 at 9:00 AM CDT at Hotel Emma, Cellar J, 136 East Grayson, San Antonio, Texas 78215 or any adjournment or postponement thereof. The undersigned acknowledges receipt of Main Street Capital Corporation’s Annual Report for the year ended December 31, 2021 and the Notice of 2022 Annual Meeting of Stockholders and related Proxy Statement. This proxy, when properly executed, will be voted as directed herein. If no direction is made, this proxy will be voted “FOR” the Election of Directors and “FOR” Proposals 2, 3, 4, 5, 6, and 7. The proxy holders named above also will vote in their discretion upon such other business as may properly come before the meeting or any adjournment thereof, including procedural matters and matters relating to the conduct of the meeting. You are encouraged to specify your choices by marking the appropriate boxes on the reverse side. The proxies cannot vote your shares unless you sign and return this card or vote by telephone or Internet as described below before the Annual Meeting. Voting by telephone or Internet eliminates the need to return this proxy card. Your vote authorizes the proxies named above to vote your shares to the same extent as if you had marked, signed, dated and returned the proxy card. Before voting, read the Proxy Statement and Proxy Voting Instructions. Thank you for voting. (Continued and to be marked, dated and signed on other side) PLEASE DETACH ALONG PERFORATED LINE AND MAIL IN THE ENVELOPE PROVIDED. Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held May 2, 2022 The Proxy Statement and our 2021 Form 10-K Report are available at: http://www.viewproxy.com/MainStreetCapital/2022 |