Minority Recapitalization

Business owners regularly face difficult decisions trying to meet both personal and professional financial goals.

Business owners regularly face difficult decisions trying to meet both personal and professional financial goals.

How can I diversify my assets and protect my wealth without having to sell my company?

When I am ready to retire, how can I transfer control / ownership to the next generation, whether my children or my trusted management team?

How can I take advantage of new growth opportunities without having to use my personal assets as collateral?

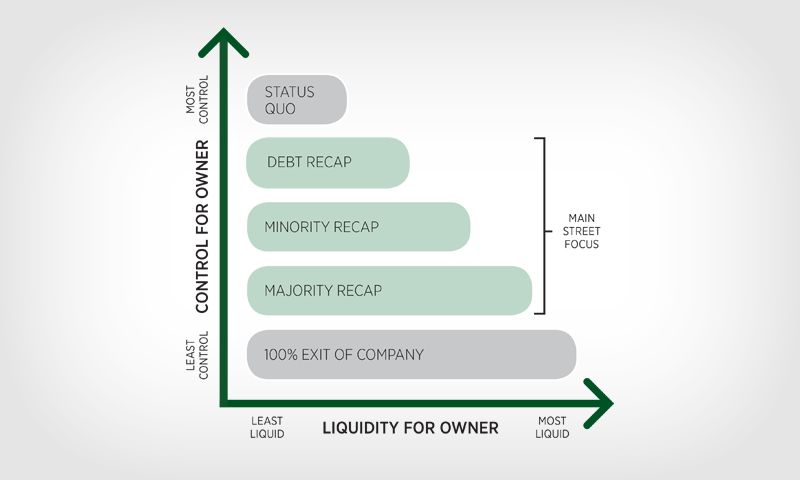

A flexible liquidity solution using debt and/or equity that can be customized to meet the unique needs of a business owner

The sale of 1% - 49% of a company, depending on what's best for the business and its owners

Debt is typically used in conjunction with minority equity to provide additional liquidity (and/or growth capital)

The use of debt can be tax advantageous, allow for more liquidity, and reduce dilution to existing equity owner

| Minority Recapitalization | Majority Recapitalization |

|---|---|

|

Minority Recapitalization Retain ownership control and preserve operational control |

Majority Recapitalization Ownership control transfers to new majority owner |

|

Minority Recapitalization Obtain partial-liquidity to diversify assets |

Majority Recapitalization More cash to owner at close |

|

Minority Recapitalization Continue to benefit from the success of the business via a potential future liquidity event |

Majority Recapitalization Less economic participation in future growth of company |

|

Minority Recapitalization Family members often want to remain active in the business |

Majority Recapitalization Owners less concerned about transitioning control to family members and/or existing management team |

|

Minority Recapitalization Lower debt / leverage levels |

Majority Recapitalization Less concern about future debt / leverage |

|

Minority Recapitalization Owners can regain 100% ownership of the company by buying back equity |

Majority Recapitalization Very difficult to regain 100% ownership |

- John Biles, Jr., CEO, J&J